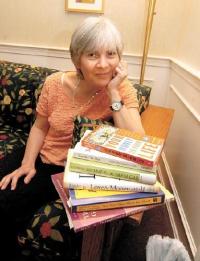

Szifra is profiled by the Lowell Sun

By Dan O’Brien

July 15, 2007

Lowell native Szifra Birke is part of nascent trend to incorporate psychology into wealth advising

CHELMSFORD — It wasn’t too long ago that the thought of using a licensed psychotherapist to assist people in their money matters was… well, farfetched.

But Lowell native Szifra Birke has been ahead of the curve before.

She helped adult children deal with their parents’ alcoholism in the 1970s, long before such counseling became mainstream. A decade later, she spent one day a week down the hallway from a physician to consult with people dealing with various medical issues.

Now she has a new title: wealth counselor. Or, as she prefers, “financial behavior specialist.”

“Money is a lightning rod for emotions,” said Birke, 57, during a recent interview at her Courthouse Lane office. “In many ways, it defines us. It could be a source of self-esteem, security or even guilt. But people would rather reveal an extramarital affair or their children’s drug problems than talk about how much money they have.”

A few years ago, Birke was first a client of Lexington Wealth Management, a firm that advises the suddenly wealthy and high-net worth individuals in transition situations — the death of a spouse, a divorce or the sale of a family business. She began informally counseling staff members, finding that while many were more than efficient at properly setting up portfolios, they came up short in responding to clients’ emotional needs.

“It’s not what they’re trained to do,” Birke said in their defense. “They were financially qualified, but not emotionally qualified. My work will revolve around increasing their emotional intelligence, and to make sure they really hear everything their clients say.”

In May, Birke was put on retainer by Lexington Wealth, which is in fact located in Lexington and has $250 million in assets under management. She said about 80 percent of her work involves meeting with staff, although she sits in on some financial planning sessions as well.

Michael Tucci, co-founder of Lexington Wealth, admitted to being wary at first.

“I started as a CPA (certified public accountant) and, quite frankly, I felt it was wrong to broach the subject of emotions,” he said, adding that a visit to a prospect changed all that.

“He was a developer and he was difficult to deal with,” Tucci recalled. “I had pages and pages of information on the attributes of our firm. He kept saying ‘So what?’ and then I noticed the page with Szifra’s offerings on it. I tried to hide it, thinking he would say it was ridiculous, but he saw it and said, ‘You have a psychologist? Hey, I’m just messed up enough to need this.'”

Dr. James Grubman, a psychologist from Turners Falls who works with several financial firms, said a common problem for those coming into sudden wealth is identity.

“When you’re middle class or working class, it’s disorienting — particularly if your beliefs about the rich weren’t very good,” Grubman said. “You may have thought of them as old, greedy and self-centered, so now that you’re rich, you must reconcile that.”

Birke, whose parents operated the Birke’s Department Store in downtown Lowell for several decades, explained that people who suddenly come into money go through at least two stages. The first is a honeymoon phase, where they are so happy to obtain it, and the second is a stewardship phase, where they struggle to decide what to do with it.

“You’ve probably heard those stories of Lottery winners going broke after just a few years,” she said, adding that is what can happen when people are unable to harness their initial emotions. “People go through several phases as they integrate the reality of what it means to have money. They realize there are minuses, such as feeling pressure from family, friends and charities. And sometimes there’s internal pressure or guilt — I have this money, so should I help my cousin’s kid with college or by my nephew a new car?”

The field of wealth counseling is still in the nascent stages. There is no formal training, no official qualifications and no state or federal overseer.

“There are consumer protections in the sense that you should go with licensed therapist,” said Grubman, who is also an adjunct assistant professor at Bentley College in Waltham. “You will at least have the normal protections from the state in terms of ethical and professional standards. But there is not yet any single body regulating wealth counseling.”

Tucci says money management firms are tapping a key resource by using psychologists.

“I feel I have a solid background on the numbers side of things,” Tucci said. “But Szifra is here to tune us up on the interpersonal element. If you use the analogy of a doctor, she’s here to help us improve our bedside manner.”